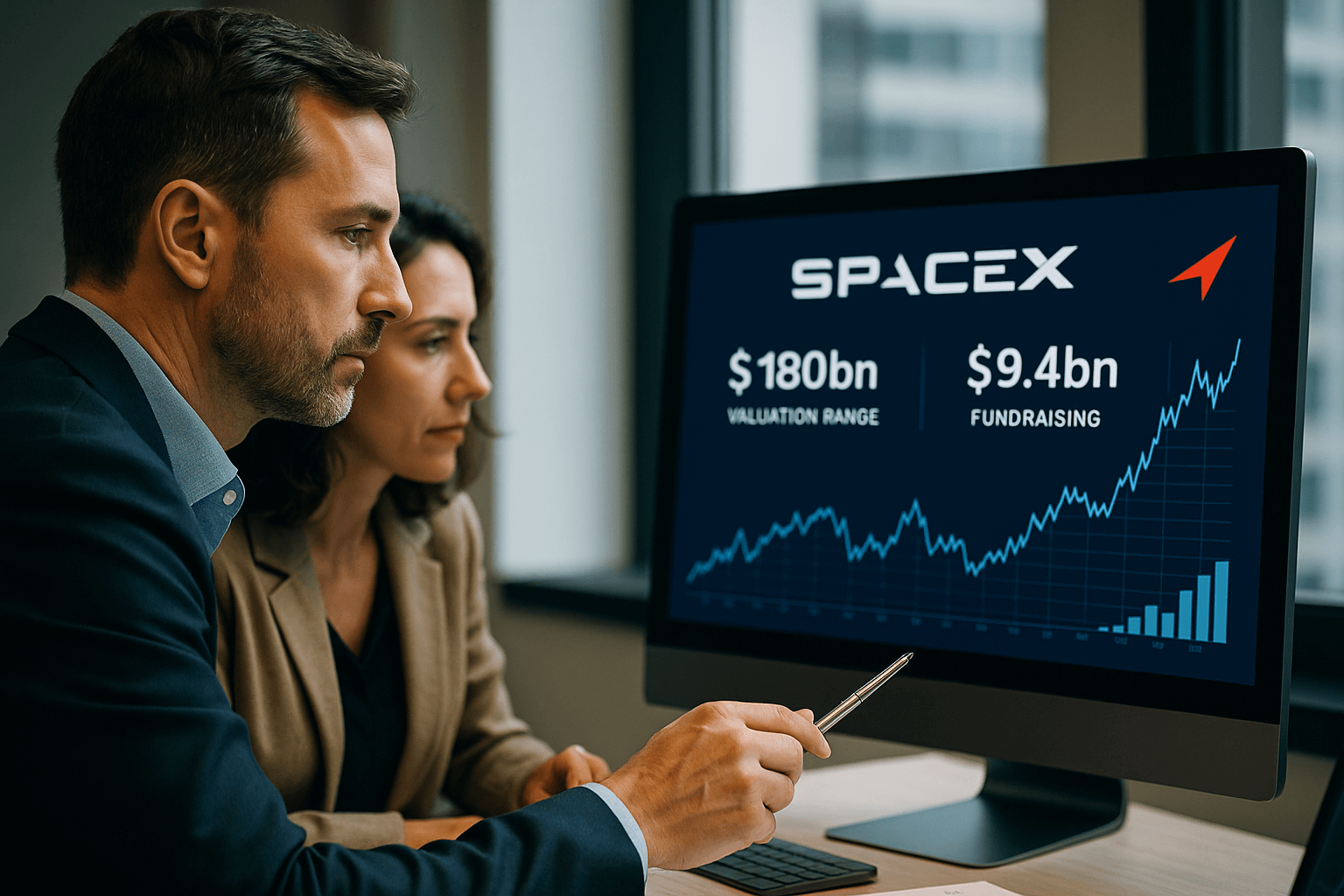

Actionable insights for investors

Independent research and timely alerts on SpaceX activity

Welcome to Investor Edge Pro, your trusted source for strategic insights into today’s most anticipated private market opportunities. Explore exclusive analysis and stay ahead of the curve with our in-depth coverage of breakthrough companies like SpaceX, shaping the future of aerospace and innovation-driven investing.

What we cover

- Valuation insights

- Funding activity

- Growth outlook

Request SpaceX updates

Questions about SpaceX updates? Talk to our team

Fill out the form to receive alerts on funding, launches, and market signals from Investor Edge Pro.

-

-

Official email

info@investoredgepro.com

Why choose SpaceX

Understanding the SpaceX Investment Landscape

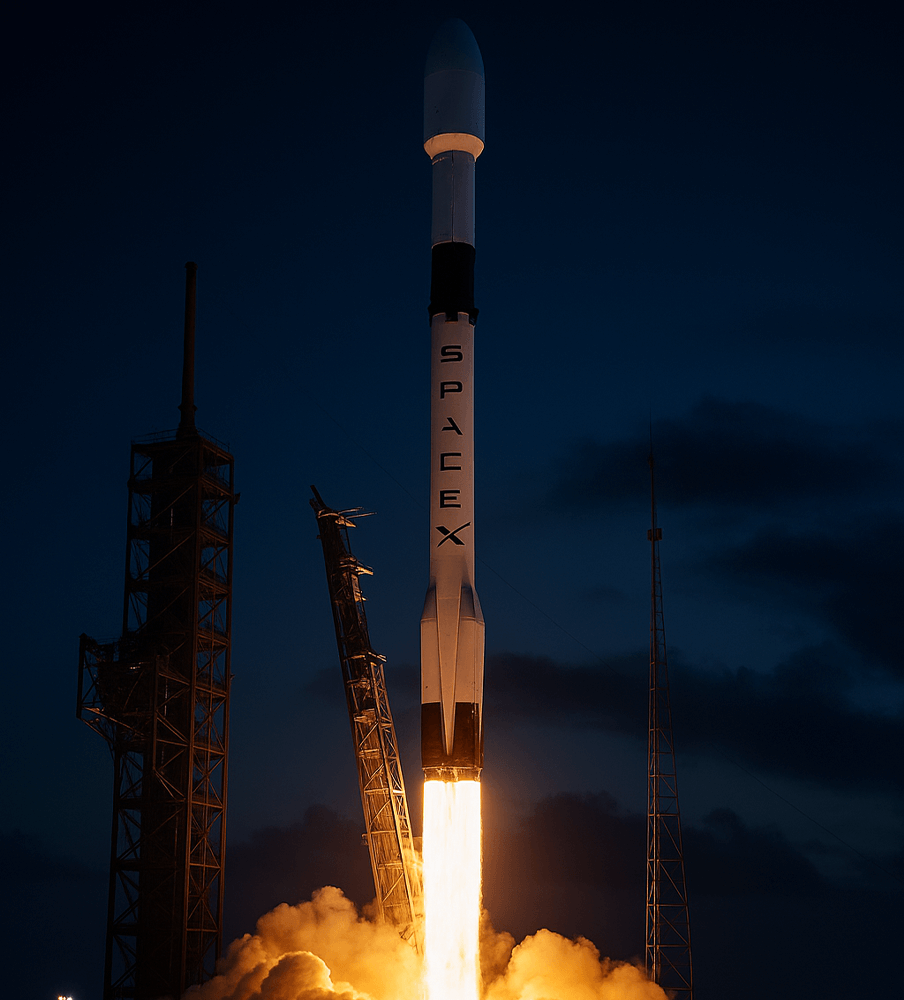

Trailblazing Innovation

As a trailblazer in funded space missions, SpaceX set new standards with the Falcon 1 and Dragon spacecraft. This commitment to pioneering innovation attracts those who value cutting edge technology and real progress in space exploration.

Dominant Market Presence

SpaceX leads commercial launch activity and holds key partnerships, including major NASA contracts and international collaborations. These alliances strengthen market position and diversify revenue, which appeals to investors.

Revolutionizing Space

Reusable rocket technology, proven by Falcon 9 and Falcon Heavy, drives costs down and improves efficiency. The approach also sets new environmental standards for aerospace technology.

Visionary Leadership

Under Elon Musk, SpaceX aims beyond launch services with programs like Starlink and long term interplanetary goals. Proven execution and clear vision make SpaceX a compelling growth story.

Stay informed

Get exclusive insights and registration details for SpaceX updates from Investor Edge Pro.

Testimonials

Investor feedback on SpaceX insights

SpaceX remains privately held, meaning direct stock purchases are limited to institutional investors and accredited individuals. However, investment opportunities exist through secondary markets and venture-backed funds that hold SpaceX shares. Investor Edge Pro provides timely alerts on pre-IPO activity and equity movements to help you stay ahead.

SpaceX’s valuation is driven by multiple factors including Starlink’s expansion, satellite deployment cadence, government and commercial contracts, and revenue from launch services. Reusability technology and successful missions continue to boost investor confidence and strengthen its market position.

Investing in private aerospace companies like SpaceX involves higher risk and limited liquidity compared to public markets. Factors such as regulatory changes, technological challenges, and capital requirements can affect returns. However, the long-term potential in space infrastructure and communications offers significant growth opportunities.